Canadian Fintech Affiliate: Honey's in hot water 🥵

PayPal's Honey 🍯 faces class action lawsuits, Circle K enters the loan biz, my interview with Patrick Sojka, Founder of FFB Group Inc and more.

Morning!

Welcome to the Canadian Fintech Affiliate newsletter, a monthly roundup of industry news, offer updates and conferences worth attending for Canadian affiliate marketers.

In today’s email:

What’s trending: Honey gets sued, Circle K & iFinance partner to offer loans, Rocket Mortgage winds down and more.

Interview with Patrick Sojka - Founder of FFB Group Inc. shares how he’s built rewardscanada.ca over 25 years and what changes are needed in the industry.

Best conferences to attend in March & April

Jobs: Roles at Gen3 Marketing, Wattpad, Pocketpills and 10+ others.

Today’s reading time is 8 minutes.

Opinions expressed are my own*

🤑 What’s Trending

Here’s the biggest news impacting financial affiliates in February 👇

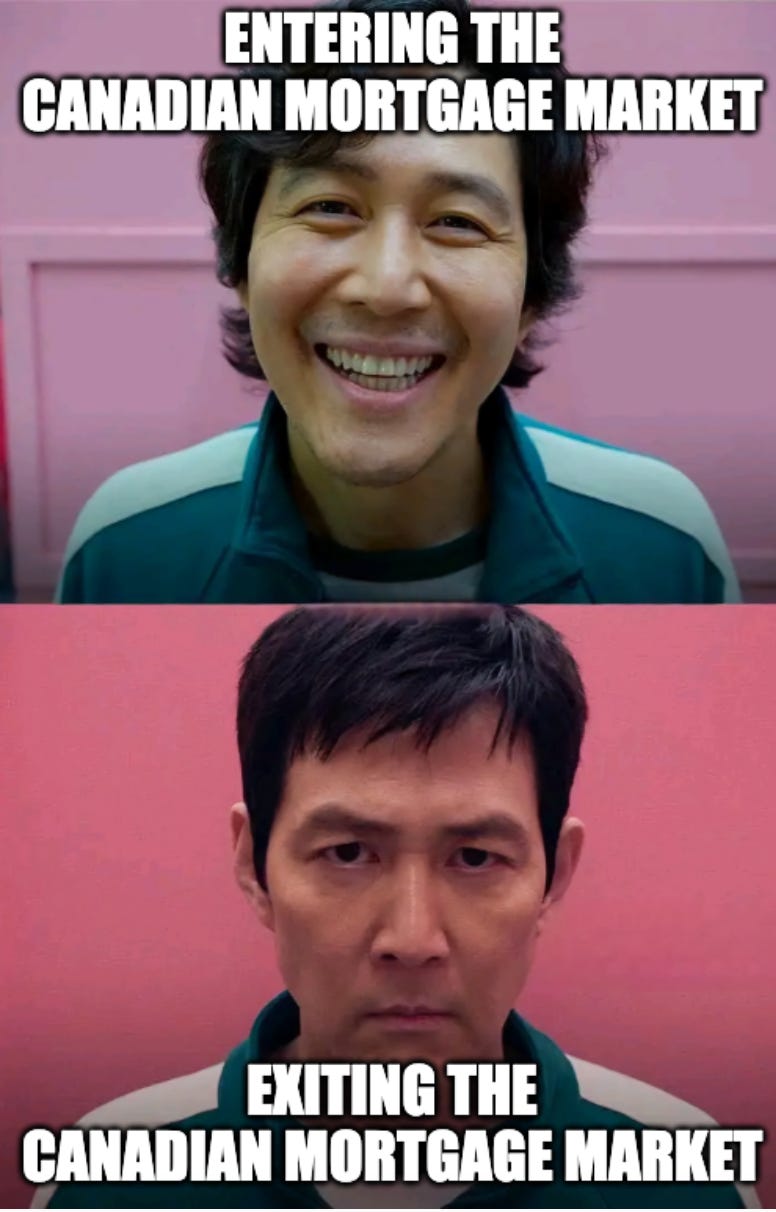

Rocket Mortgage is shutting down Canadian operations.

Tokyo's Pafin expands crypto tax platform cryptact to the Canadian market, competing with brands like Koinly and Wealthsimple Tax.

Vault Rebrands to Venn Following $21.5 Million Series A Round and looking to accelerate their growth with a new Head of Partnerships

iFinance partners with Circle K to offer personal loans in Ontario locations.

I’ll admit, my first reaction was that this seemed a bit odd. But after thinking it through, I actually think it’s pretty genius. With 706 Circle K locations in Ontario, if iFinance QR codes are rolled out in most of them, they’re not just getting high-quality traffic—they’re also gaining valuable out-of-home brand exposure.

Honey, Klarna, Capital One, and RetailMeNot are facing class-action lawsuits alleging that their browser extensions were removing affiliates' cookies and replacing them with their own to avoid paying publisher commissions—a practice I’m calling the “Honey Scrub.”

This comes after MegaLag posted a video in January accusing Honey of scamming influencers. I highly recommend watch it—it’s a great example of how attribution can work against publishers and traffic sources.There were two key ways this could have been avoided or caught sooner:

Traffic partners should only agree to work on a CPI (cost per install) or flat fee. I was shocked that these influencers were working on a CPS (cost per sale) or rev-share model. I would never in a million years have agreed to that to promote a browser extension. Perfect example of a one-sided relationship.

The affiliate managers didn’t care. I’m willing to bet at least one influencer flagged the issue with their AM at Honey, saying performance was so low that there had to be a tracking issue. And the AM probably responded with, “Everything looks fine on our end—it must be a traffic issue.” If these AMs were actually supporting their traffic partners, they would have clicked the link, checked the redirect themselves, and flagged the issue internally or moved the partners to a different payout structure.

This should serve as a cautionary tale for banks and fintechs in Canada, where tracking is often an afterthought. I’ve lost count of how many times I’ve flagged low performance and raised concerns about an attribution issue, only to be stonewalled and told it’s a traffic problem. Now I know I’m not alone.

🍸Conferences

Upcoming conferences worth checking out:

Fintech Meetup - March 10-13, 2025 | Las Vegas, US

Check this out if your looking to speak with senior leaders at Banks, Credit Unions and Fintechs.

LeadsCon - April 7-9, 2025 | Las Vegas, US

If you are looking to buy or sell leads, head to Vegas for LeadsCon.

PI Live - April 16-18, 2025 | Miami, US

This is a new one on my radar. It’s a European conference that’s expanded to Miami. Lots of people in the industry attended last year. Definitely one to watch.

💼 Affiliate Marketing Jobs

With the industry reeling and many people looking for work, I launched a job board specifically for affiliate marketing roles in Canada.

See roles from Gen3 Marketing, Wattpad, Pocketpills and 10+ others.

Check it out 👉 affiliate-marketing-jobs.com

🎙️ Interviews

Patrick Sojka - Founder of FFB Group Inc.

Who are you and what business did you start?

I’m Patrick Sojka and I started RewardsCanada.ca (RWRDS Canada) in September 2001. In 2005 we launched our global site FrequentFlyerBonuses.com. Over the years we tried a few other sites but decided to focus on those two as they were the most successful. Today we still operate the two sites and our loyalty industry consulting service under the parent name of FFB Group Inc.

What's your backstory and how did you come up with the idea?

As an AvGeek (Aviation Geek) with a deep interest in airlines, airline operations, and loyalty programs, I’ve been passionate about earning 'more miles, more points, more rewards' since the late 1980s. In the early days of the internet, there were only a handful of frequent flyer websites, and they were all US-focused. Seeing the gap, I decided to take a crack at creating one specifically for Canadians—and that’s how Rewards Canada was born.

Take us through the process of building and launching the first version of the site

The first version of the site was built using HTML 1.0. Dreamweaver was the gold standard for web design at the time, so I got the software and built Rewards Canada with it.

When did you start to see success, and how did you stay motivated?

My first major media hit came from the Financial Post around 2003, about two years after launching the site. Once the media coverage started rolling in, I realized—hold on, there’s a much bigger audience here than just frequent flyers. That was a turning point. I shifted my focus to creating content for everyone, not just points and miles experts.

As for motivation, it comes naturally when you're doing something you love. Writing about travel, rewards, and loyalty programs never felt like a job—it was a passion and, at the time, more of a hobby than a business. That mindset made it easier to stay engaged and keep going.

Since launch, what growth channels have been most effective for you?

Over the course of nearly 25 years I would have to say the most effective channel has been email and our newsletters. Despite the advent of all the new social media channels, YouTube, etc. over those years the newsletter continues to be the most effective (Not that those other channels are not effective though!)

What channels are you focusing on in 2025?

Outside of trying to provide an even focus across many channels, the focus on 2025 will be with YouTube and our weekly This Week in RWRDS Newscast. It’s another avenue to get all the latest news, offers and other information to consumers in a timely fashion when it really matters.

Another focus is continuing to grow Rewards Canada as the advocate for the Canadian consumer when it comes to loyalty programs and credit cards. For as long as I can remember, we have been that conduit between consumers and loyalty programs/credit card issuers trying to help resolve issues etc. but 2024 saw the advocacy level jump exponentially with so many issues surrounding the PC Optimum program.

You've been doing this for 20 years, what makes rewardscanada.ca stand out in a crowded field?

There are three factors that have made Rewards Canada stand the test of time and earn the respect of Canadians.

1. Originality - where we are not rehashing or mimicking other’s content and just the vast coverage of everything imaginable in the world of points, miles and credit cards. The articles, features, and tools are provided in an informative style that works for all Canadians, beginners and experts alike. No matter how big or small, I will try to write about it. In terms of writing, I haven’t handed off the day-to-day content writing to others as I feel that is key to keeping the integrity of providing proper information and originality to our readers.

2. Putting the Canadian consumer first and providing them with proper information. I always cringe when I read articles claiming this credit card or financial product or whatever is the best when they are not. You can tell those articles are one of two things (or both) and that’s simply to earn more commissions or the writers lack the knowledge of the products and the industry. We aim to tell the entire story.

3. RWRDS Canada is fully entrenched in the loyalty industry - we are not just a website/blog/influencer. For the past 15 years I have presented at and attended loyalty industry conferences. Provided banks, loyalty programs, venture capitalists and others with feedback and consulting on products or program changes. I also speak and meet with airlines, hotels, banks and loyalty programs on a regular basis.

Put all three together and that’s what I like to call the "RWRDS Canada difference"

What do you look for when evaluating partnership opportunities with new advertisers (direct or through an affiliate network)?

I look for relevance to the Rewards Canada community and the typical readers of the site. Over 20 years, we’ve tried partnering with everything under the sun for affiliates and advertisers and have learned what works and what doesn’t. Have a travel, loyalty program or credit card component to your company? Most likely it may have some success with us. Come to us seeing if we can help you sell more shoes, well that just isn’t going to happen.

In your opinion, what is the industry in Canada missing? What would you like to see change?

I think the affiliate industry in Canada (and worldwide) is missing good payment practices. As someone who spent nearly 20 years in the oil industry in supply chain management, procurement and sales, I can tell you the payment terms of the affiliate industry would not fly in that industry!

The affiliate networks between the merchants and publishers should be paying the publishers on a regular basis, whether or not they have been paid by the merchant on time.

Of course that’s not the case, the affiliate networks don’t pay publishers until they get paid, I’ve seen it take 6 months or even 12 months on occasion to have payments for approved transactions come through. In other industries, the intermediary needs to either have funding in place or a credit line in place to pay monies owed on time and in turn that lights a fire under the intermediary to push the merchant for timely payments. As it is, I don’t see the affiliate intermediaries making much effort to push merchants when they are late in paying.

Where can we go to learn more?

You can learn all about Rewards Canada at www.rewardscanada.ca or rwrds.ca

***— Are you interested in being interviewed for my newsletter? Reply to this email.***